Why Are Taxpayers Feeding

Biotech Fat Cats?

We pay too much for health care, especially prescription drugs, and we get too little in return. That's the reality, and some Massachusetts politicians make it even worse by encouraging drug companies to feed at the public trough.

Dr. Marcia Angell of Harvard Medical School has written extensively about how "the industry, corrupted by easy profits and greed, has deceived and exploited the American people" and "has moved very far from its original high purpose of discovering and prescribing useful new drugs" by becoming "primarily a marketing machine to sell drugs of dubious benefit."

She points out in her 2005 book, The Truth About the Drug Companies, that "only a handful of truly important drugs have been brought to market in recent years," and these were "mostly based on taxpayer-funded research…"

The true cost of research & development (R&D) is usually "hidden from view," according to longtime health care reformer Rep. Henry Waxman (D-Calif.). As Dr. Angell explains, much of R&D expenses which are "fully tax-deductible" may really be marketing costs and taxpayers pay for "promotional practices [aimed mostly at doctors that] can only be described as bribery and kickbacks."

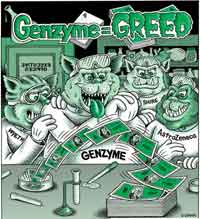

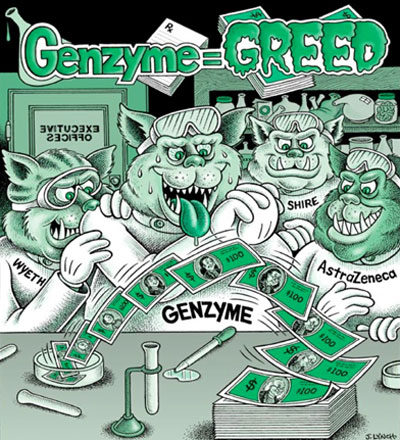

As the Big Pharma plot thickens, let's take a look at four companies whose behavior truly sickens.

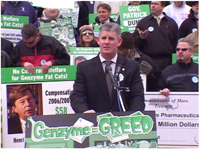

The Biggest Dose of 'Price Gouging'

Genzyme, founded in Delaware and headquartered in Cambridge, became a leading biotech company primarily because of one product it has the exclusive right to sell: Cerezyme, a treatment for Gaucher's disease.

"Perhaps the most extreme example... of price gouging" in the industry is how Dr. Angell, the former editor-in-chief of the New England Journal of Medicine, describes Cerezyme.

Research and early development was federally funded by the National Institutes of Health, but Genzyme gets away with charging individual patients as much as $300,000 a year or more for the medicine. Sales of Cerezyme have exceeded $1 billion a year in each of the last three years.

Some experts say Genzyme bolsters its profits through the too-common industry practice of inflating recommended dosages. Patients may need only one-fourth of what Genzyme recommends doctors to prescribe. "It is economic malpractice to give a much higher dose of an expensive drug than is required," Dr. Ernest Beutler of the Scripps Research Institute told The New York Times (3/16/08).

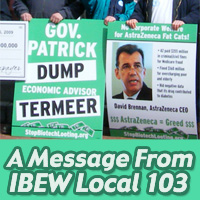

In addition to reaping billions from drugs developed at taxpayer expense, Genzyme benefits from extended patent protection and tax credits from the federal government's "orphan" drug program. Massachusetts politicians first unlocked the treasury for Genzyme in 1991, when the City of Boston virtually froze Genzyme's property taxes for 15 years, the State provided new tax credits, and the Turnpike Authority granted a favorable 60-year lease on its property. In June 2008, Gov. Deval Patrick proposed and the Legislature approved giving $1 billion to biotech firms ($250 million in tax breaks, $250 million in grants and $500 million in infrastructure costs). Patrick's 2008 appointment of Henri Termeer, Genzyme's CEO, to his Council of Economic Advisors, may enable Termeer to increase his and Genzyme's already exorbitant income.

Ethical Conflicts, Tax Avoidance, Etc.

Shire's marketing of its best-selling amphetamine stimulant Adderall, widely prescribed for children diagnosed with Attention Deficit Hyperactivity Disorder (ADHD), raises serious ethical questions. In 2002, Shire reportedly bought most copies of an ADHD patient advocacy group's magazine and had sales reps place them in doctors' offices. The Shire-supported magazine cut passages critical of the tendency to over prescribe anti-ADHD drugs from an interview with prominent researcher Dr. William Pelham, and the company pulled funding from a conference organized by Pelham. Pelham later cited some doctors' and groups' "major and undisclosed conflicts of interest" with drug firms like Shire.

British-based Shire in 2008 switched its legal incorporation to Jersey, an offshore island tax- avoidance haven, and shifted its tax base to Ireland, where the corporate tax rate is less than half that in Britain.

After 14 children and six adults died, Canadian regulators in 2005 halted sales of Adderall-XR until new warning guidelines were agreed upon 6 months later. Meanwhile in Massachusetts, Shire pressured state and local officials for corporate welfare in connection with its plan to locate a new building in Lexington. The firm got $40.5 million from the state and $7.6 million in subsidies from the town.

Fraud, Deception, Concealed Payments

In 2003, AstraZeneca pleaded guilty to a felony conspiracy charge that it defrauded the Medicare program and agreed to pay $355 million in criminal fines. The company was charged with giving doctors free samples of a costly cancer drug knowing they would bill Medicare and pocket those fees.

In 2007, a federal judge in Boston ordered AstraZeneca and two other firms to pay damages for overcharging on drugs paid for by Medicare and employee benefit plans. The judge said the companies acted "unfairly and deceptively" by falsifying wholesale prices. In 2008, the company was ordered to pay $160 million in damages to Alabama's Medicaid Agency for fraudulently overcharging the poor and elderly.

The New York Times in 2008 exposed the corrupting influence of drug companies' "consulting fees," which some researchers grossly understate or fail to disclose to their universities as they are required to. A prime example was a University of Cincinnati professor who told school officials that she earned about $100,000 from eight drug firms in 2005-7, when "AstraZeneca actually paid her $238,000."

In the U.S. and Canada, AstraZeneca's controversial anti-psychotic drug Seroquel has been the subject of numerous class-action and personal injury lawsuits alleging that it caused people to develop diabetes.

Horses, Hormones and Tales of Horror

Advocates for animals have long decried Wyeth's hormone replacement therapy (HRT) drug, Premarin, obtained from the urine of pregnant horses confined in cramped stalls, denied free access to water and made to stand up for twenty hours a day, only to be auctioned and slaughtered when too old to bear foals.

But horses aren't the only victims. Thousands of women have sued Wyeth after taking Premarin or another HRT drug and developing breast cancer. In 2008, a jury awarded three such Nevada women $134 million (later reduced to $58 million).

The diet drug fen-phen was withdrawn from sale more than a decade ago after it was linked to heart damage. Wyeth has paid well over $10 billion to resolve lawsuits over the drug.

Now Wyeth, recently acquired by the largest U.S. drugmaker Pfizer, and other firms are "hoping the Supreme Court will sharply curb" the "right to sue drug companies for deaths or injuries caused by medicines" (Wall Street Journal, 10/27/08).

In Wyeth vs. Levine, a Vermont guitarist who lost an arm to gangrene caused by an improperly administered nausea drug was awarded $6.7 million in damages by a jury accepting her argument that Wyeth should have put stronger warnings on the label. Vermont's highest court upheld the verdict, but in an appeal Wyeth seeks what a New York Times editorial (11/7/08) described as "grant(ing) drug companies immunity based on a phony assertion that state lawsuits improperly usurp federal regulatory authority."

Gluttons Who Push the Buttons

Big Pharma's CEOs and directors believe they are a privileged class, entitled to exorbitant salaries and other compensation.

Take Genzyme, which paid its five top officers $53.1 million in 2007, of which CEO Henri Termeer alone received $35.6 million. The company also paid its seven outside directors $3.7 million in 2007, a remarkably large sum for attending a few meetings. (Most officers and directors have multiple sources of income, too.)

One director, Richard Syron, was disgraced and removed as chairman/CEO of the Federal Home Loan Mortgage Corp. (Freddie Mac), which paid him $19.8 million in 2007 even though its stock lost half its value and in 2008, foreclosures decimated countless families.

Wyeth's recently retired chairman and CEO Robert Essner raked in $57.6 million in 2006 and $33 million in 2007, when Bernard Poussot, his successor as CEO, pocketed a mere $23.1 million and $15.3 million.

We're Sick of Paying for Fat Cats' Feast

For 60-plus years, unions have fought for affordable, quality health care for all. Many politicians have now become willing servants of the "Gimme, Gimme" gang that runs the pharmaceutical/biotechnology business. That's why members and supporters of International Brotherhood of Electrical Workers (IBEW) Local 103 are holding them accountable.

As corporate greed cripples the economy, the cost of health care spirals out of control. The four Big Pharma firms profiled in this report are prime examples of what's wrong. It's time to rein in those who keep stuffing the already bulging pockets of the ethics-challenged corporate predators. It's time to expose and oppose the lavish subsidies, tax breaks and "research grants" that encourage their irresponsibility.

Industry apologists claim that "public-private partnerships" are the key to creating jobs and saving lives. But what about firefighters and others with modest incomes and strained budgets who really do save lives and put their own lives at risk?

It shouldn't surprise anyone that our four rogue companies cut corners on suburban construction projects that have begun or are planned in eastern Massachusetts: Genzyme (in Framingham), Shire (Lexington), Wyeth (Andover) and AstraZeneca (Waltham). Their general contractors use subcontractors that don't hire union electricians and other local workers who are graduates of the best apprentice training programs, earn area-standard wages and benefits (including health coverage) and deliver top-quality work at job sites that are constantly monitored for safe working conditions.

As he was heading for a biotech trade show in California where he was honored as "Governor of the Year," Deval Patrick said, "We've got an awful lot to offer. We are all about selling it." But "selling it" doesn't have to mean selling out taxpayers' interests or past commitments to working families.

How You Can Help

Support Local 103's campaign to challenge the Big Pharma/Biotech fat cats by sending the coupon below to Gov. Patrick.

Dear Gov. Patrick:

With the state budget and household budgets strained to the limit, there couldn't be a worse time to waste taxpayer dollars on corporate welfare for the biotech industry. The appointment of Genzyme Corp. CEO Henri Termeer to your Council of Economic Advisors should be rescinded. Before more tax dollars are wasted on $35 million-a-year Termeer and his peers, tough controls should be imposed immediately on all disbursements of public funds to firms like his that engage in unscrupulous behavior and drive up the cost of health care for everyone.

Please let me know how you intend to respond to my concerns.

Sincerely,

Name

Address

City

State ZIP

Please mail to:

Gov. Deval Patrick

Massachusetts State House

Office of the Governor, Room 360

Boston, MA 02133