Pfizer = Greed

Pfizer Inc.

235 E. 42nd Street

New York, NY 10017

212-733-2323

www.pfizer.com

Employees: 116,500

2009 revenues: $50 billion

2009 net income: $8.6 billion

Publicly traded on New York Stock Exchange; ticker symbol: PFE

As of October 16, 2009, Wyeth became a wholly owned subsidiary of Pfizer Inc. Two members of the board of Wyeth are now on the board of Pfizer – Frances Fergusson and John Mascotte.

Below the Pfizer information, we include information about Wyeth (before the merger) to better understand the unbridled greed involved in this merger. The companies, now one institution under the Pfizer name, do not have respectable records as socially-responsible corporations.

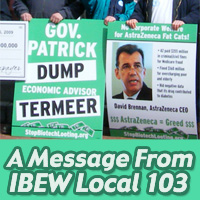

The intimate connections between Pfizer and Prudential are also noteworthy. Prudential Financial, like Pfizer/Wyeth, also has a disreputable history and is using its financial clout to undermine the labor movement and, specifically, working conditions for IBEW Local 103 members by making building projects free of union electricians.

Two of Pfizer's directors, William H. Gray, III and Constance Horner, are also directors of Prudential Financial, which on 12/31/09 held 27,817,766 shares of Pfizer's common stock valued at $495,434,412.

Top Executives

Jeffrey B. Kindler

Chairman and Chief Executive

2009 Compensation: $14.9 million

Kindler joined Pfizer in 2002 as Executive Vice President and General Counsel. He was named Vice Chairman in 2005 and appointed CEO in 2006. He serves on the boards of the Federal Reserve Bank of New York and Tufts University.

Frank D’Amelio

Senior Vice President and Chief Financial Officer

He joined the company in September 2007. He serves on the Board of Directors of Humana, Inc. and the JPMorgan Chase National Advisory Board.

Martin Mackay

Senior Vice President & President-PharmaTherapeutics Research & Development

Mackay began his career at Pfizer in 1995 and he is a board member of ViiV Healthcare, the global specialist HIV company established by GlaxoSmithKline and Pfizer. He serves on the Scientific and Regulatory Committee of the industry trade group PhRMA.

Pfizer 2009 Executive Compensation

2009 |

Total compensation |

J. Kindler, Chairman and Chief Executive Officer |

$14,898,038 |

F. D'Amelio, Chief Financial Officer |

$7,858,969 |

I. Read, Group President, Worldwide Biopharmaceutical Businesses |

$9,447,036 |

M. Mackay, President, Pharmatherapeutics Research & Development |

$5,878,806 |

F. Lewis-Hall, Chief Medical Officer |

$5,087,263 |

(***CLICK to view the entire table)

BOARD OF DIRECTORS

Dennis A. Ausiello, M.D.

The Jackson Professor of Clinical Medicine at Harvard Medical School and Chief of Medicine at Massachusetts General Hospital since 1996. Director of MicroCHIPS (drug delivery technology).

Michael S. Brown, M.D.

Director since 1996. Distinguished Chair in Biomedical Sciences since 1989 and Regental Professor since 1985 at the University of Texas Southwestern Medical Center at Dallas and Director of Regeneron Pharmaceuticals, Inc.

M. Anthony Burns

Our Director since 1988. Director of The Black & Decker Corporation and J.C. Penney Company, Inc. Life Trustee of the University of Miami.

Robert N. Burt

Director since 2000. Retired Chairman and Chief Executive Officer of FMC Corporation.

W. Don Cornwell

. Our Director since 1997. Vice Chairman of the Board of Directors of Granite Broadcasting Corporation since August 2009. Director of Avon Products, Inc. Director of the Wallace Foundation.

Frances D. Fergusson, Ph.D.

Director since October 2009. Dr. Fergusson is President Emeritus of Vassar College. Director of Mattel, Inc.

William H. Gray III

Director since 2000, William H. Gray III is Co-Chairman of the Gray-Loeffler Group, a business advisory and consulting firm. Former U.S. Congressman from the Second District of Pennsylvania from 1979 to 1991.

Director of Dell Inc., J. P. Morgan Chase & Co., Prudential Financial, Inc. and Visteon Corporation.

Constance J. Horner

Director since 1993 and Lead Director since February 2007. Director of Ingersoll-Rand Company Limited and Prudential Financial, Inc., Fellow, National Academy of Public Administration; Member of the Board of Trustees of the Prudential Foundation.

James M. Kilts

Director since September 2007. Founding Partner, Centerview Partners Management, LLC, a private equity and financial advisory firm, since 2006. Director of Metropolitan Life Insurance Company and Meadwestvaco Corporation. Trustee of Knox College and the University of Chicago.

Jeffrey B. Kindler

Pfizer Chairman and CEO. See biography above.

George A. Lorch

Director since 2000. Chairman Emeritus of Armstrong Holdings, Inc. Director of Autoliv, Inc. and The Williams Companies, Inc., HSBC Finance Co. and HSBC North America Holding Company.

John P. Mascotte

Director since October 2009. Retired President and Chief Executive Officer of Blue Cross and Blue Shield of Kansas City, Inc.

Suzanne Nora Johnson

Director since September 2007. Retired Vice Chairman, Goldman Sachs Group, Inc. Director of American International Group, Inc., Intuit and VISA.

Stephen W. Sanger

Director since February 2009. Former Chairman and CEO of General Mills, Inc. Director of Target Corporation and Wells Fargo & Company.

William C. Steere, Jr.

Director since 1987 Director since 1987, Former Chairman and CEO of Pfizer Inc. Director of MetLife.

2009 Non-Employee Director Compensation

| Name | Fees Earned |

Stock Awards(1) |

All Other |

Total |

or Paid in Cash |

($) |

Compensation (2) |

($) |

|

($) |

($) |

|||

Dr. Ausiello |

127,014 |

73,040 |

6,500 |

206,554 |

Dr. Brown |

143,403 |

73,040 |

— |

216,443 |

Mr. Burns |

108,611 |

73,040 |

— |

181,651 |

Mr. Burt |

101,806 |

73,040 |

30,000 |

204,846 |

Mr. Cornwell |

113,611 |

73,040 |

10,000 |

196,651 |

Dr. Fergusson |

16,816 |

97,130 |

13,050 |

126,996 |

Mr. Gray |

103,611 |

73,040 |

318 |

176,969 |

Ms. Horner |

125,000 |

73,040 |

250 |

198,290 |

Mr. Kilts |

101,806 |

73,040 |

15,000 |

189,846 |

Mr. Lorch |

105,000 |

73,040 |

1,000 |

179,040 |

Mr. Mascotte2 |

16,816 |

97,130 |

— |

113,946 |

Dr. Mead1 |

110,000 |

73,040 |

25,000 |

208,040 |

Ms. Nora Johnson |

118,611 |

73,040 |

15,000 |

206,651 |

Mr. Sanger |

95,972 |

153,230 |

— |

249,202 |

Mr. Steere |

85,000 |

73,040 |

80,000 |

238,040 |

*** 1. Dr. Mead did not run for the board in 2010.

*** 2. Mr. Mascotte joined the board in October 2009.

Business Update

In January 2009, Pfizer, Inc. and Wyeth announced that they had reached an agreement whereby Pfizer would acquire Wyeth in what was described as "a blockbuster deal that values Wyeth at $68 billion and creates the world's largest pharmaceutical company, with initial sales totaling $71.3 billion." On October 16, 2009, Wyeth became a wholly owned subsidiary of Pfizer Inc.

On January 27, 2009, the Hartford Courant reported that Pfizer confirmed its planned acquisition of Wyeth would lead to thousands of layoffs.

The Washington Post ran an article on January 28, 2009, entitled "Not What the Doctor Ordered." Reporter Steven Pearlstein wrote: "Three things are indisputably true about the pharmaceutical industry:

"Over the past decade, there has been significant cross-border consolidation, involving major pharmaceutical companies and promising biotech firms.

"Whatever operating efficiencies that consolidation may have generated, none of it was passed on to consumers in the form of lower prices.

"During the same period, there has been a steady decline in the number of important new drugs flowing from company research labs.

"All of which ought to raise serious questions about why the government's antitrust regulators should approve the latest industry mega-merger in which No. 2 Pfizer proposes to buy No. 11 Wyeth in a deal valued at $68 billion.

"The impetus for this merger couldn't have been clearer: In 2011, the patent will expire on Pfizer's blockbuster cholesterol-lowering drug, Lipitor, which now accounts for a quarter of the company's revenue, and there is little in Pfizer's development pipeline to replace it.

"Unable to stop the slide in its stock price by creating new drugs, Pfizer has concluded that the next best way to keep shareholders happy is through financial engineering…"

"It is also important to remember that this is an industry that deserves to be treated with deep suspicion by antitrust regulators because of its congenital distaste for competition.

"It is an industry that spends lavishly on lawyers and lobbyists to protect and extend its patents and throw up endless challenges to approvals of competitive drugs.

"It is an industry in which companies rarely compete on the basis of price, both because its patents give it near-monopoly pricing power and because the people who decide which drug to use (doctors) are not the ones who pay the bills (insurers and consumers).

"It is an industry in which companies facing expiration of lucrative patents routinely pay millions of dollars to potential rivals to delay the introduction of lower-priced generic drugs under the guise of "joint ventures"— payments that the Federal Trade Commission has described as kickbacks designed to lessen competition…

"The Pfizer-Wyeth deal offers a wonderful opportunity for a new administration in Washington to signal the end of the era of anything-goes mergers, and to apply the antitrust laws in creative new ways to innovative high-tech industries that are the key to America's economic future."

[see link to full article below]

Sensitive Issues

Pfizer has been at the center of one controversy or another since the late 1950s, when it pioneered aggressive marketing techniques for its prescription drugs. A prominent article in the Saturday Review denounced the company for tactics such as running ads for its antibiotics that displayed the names of doctors who were supposedly endorsing the product but who turned out to be fictitious.

During the 1980s the company came under fire when serious manufacturing defects were blamed in the deaths of scores of people using artificial heart valves made by Pfizer's Shiley division.1 In 1986 Pfizer ended production of the valves, but by that point they were implanted in tens of thousands of people, who worried that the devices could fracture and fail at any moment. In 1990 a Congressional investigation charged that Pfizer knowingly sold the valves even after it knew of the dangers and that it failed to keep the Food and Drug Administration fully informed of the problems.2

In 1992 Pfizer agreed to pay up to $205 million to settle lawsuits that had been brought in connection with the valves, which by that point had been implicated in about 300 deaths.3 Even so, Pfizer resisted complying with an FDA order that it notify patients of new findings that there was a greater risk of fatal fractures.4 In 1994 the company agreed to pay $10.75 million to settle Justice Department charges that it lied to federal regulators about the valves.5

Pfizer also ran into new trouble with its advertising practices. In 1991 the company paid a total of $70,000 to 10 states to settle charges relating to misleading advertising for its Plax mouth rinse.6 In 2003 Pfizer paid $6 million to settle with 19 states that had accused the company of using misleading ads to promote its Zithromax medication for children's ear infections.7 In 2008, Pfizer cancelled a new series of ads for Lipitor featuring artificial heart inventor Robert Jarvik amid a Congressional investigation of charges that the ads were misleading.8

Along with deceptive marketing to consumers, Pfizer was accused of inducing doctors to prescribe its products in improper ways. In 2004 the company agreed to pay $430 million to resolve criminal and civil charges that it paid physicians to prescribe its epilepsy drug Neurontin to patients with ailments for which the medication was not approved.9 Documents later came to light suggesting that Pfizer arranged for delays in the publication of scientific studies that undermined its claim for the other uses of Neurontin.10

The company also faced criticism of its high drug prices. In 2002 Pfizer resisted cooperating with a General Accounting Office investigation of industry pricing practices but relented after chairman and CEO Henry McKinnell was served with a subpoena. Later that year, Pfizer agreed to pay $42 million to settle charges that one of its subsidiaries defrauded the federal Medicaid program by overcharging for its cholesterol-lowering drug Lipitor.11

In 2004, in the wake of revelations about dangerous side effects of Merck's painkiller Vioxx, the FDA pressured Pfizer to remove its similar medication Bextra from the market. The company also agreed to suspend television advertising for a related medication called Celebrex. When Pfizer resumed advertising of the drug in 2007 it did so with a commercial that was criticized by the watchdog group Public Citizen for making false or misleading statements about its risks.12

In 2008, Pfizer announced that it was setting aside $894 million to settle the lawsuits that had been filed in connection with Bextra and Celebrex.13 Yet in 2009 the company had to pay much more – $2.3 billion – to resolve criminal and civil charges related to the improper marketing of Bextra and three other medications. The amount was a record for a healthcare fraud settlement. John Kopchinski, a former Pfizer sales representative whose complaint helped bring about the federal investigation, told the New York Times: "The whole culture of Pfizer is driven by sales, and if you didn't sell drugs illegally, you were not seen as a team player."14

On March12, 2010, CNN's AC360° ran a story raising the question, Is Pfizer too big to be allowed to fail. Although Pfizer had been fined $2.3 billion, the largest healthcare fraud settlement in the history of the U.S. Justice Department over fraudulent marketing practices, the fine was like a slap on the wrist equal to about three months profits for the company. By law, a company convicted of major fraud should automatically be kicked out of Medicare and Medicaid. And high level executives should receive prison sentences. What CNN's report points out is how the government allowed Pfizer to place the blame on subsidiaries that were companies on paper only, with no assets. This basically allows Pfizer to continue with business as usual.

What makes the fraudulent marketing practices so serious is that Pfizer placed many patients at risk and bilked the healthcare system and taxpayers out of hundreds of millions of dollars.

Pfizer apparently engaged in questionable practices abroad as well. In 2000 the Washington Post published a major expose accusing Pfizer of testing a dangerous new drug on children in Nigeria without receiving proper consent from their parents.15 The experiment occurred during a 1996 meningitis epidemic in the country. In 2001 Pfizer was sued in U.S. federal court for human rights violations and was then the subject of a criminal investigation by the FDA. In 2006 a panel of Nigerian medical experts concluded that Pfizer had violated international law.16 In 2009 the company agreed to pay $75 million to settle lawsuits brought in Nigerian courts.17

With the acquisition of Wyeth in October 2009, Pfizer took on a new set of legal problems. The summary of legal proceedings in Wyeth's last annual financial report before the deal was announced went on for 14 pages.18 Most of the lawsuits discussed were product liability cases involving hormone therapy, childhood vaccines, the anti-depressant Effexor, the contraceptive Norplant and, most importantly, the combination diet drug known as fen-phen, which was withdrawn from the market more than a decade ago after reports that its use was linked to possibly fatal heart valve damage. The findings unleashed a wave of tens of thousands of lawsuits against the company, formerly known as American Home Products, including a case in Texas in which a jury awarded a single plaintiff more than $1 billion in damages. The company set up a $3.75 billion fund as part of the attempted resolution of a national class action case. Another $1.3 billion was added to the fund in 2006. Many plaintiffs opted out of the class and negotiated individual settlements with the company.

- Irvin Molotsky, "Recall Urged of Heart Valve Said to Have a Serious Defect," New York Times, June 27, 1985, p.D23; http://www.nytimes.com/1985/06/27/us/recall-urged-of-heart-valve-said-to-have-a-serious-defect.html

- "State Officials Urged to Prosecute Pfizer in Heart Valve Cases," Corporate Crime Reporter, March 12, 1990.

- "Lawsuit Settled Over Heart Valve Implicated in About 300 Deaths," New York Times, January 25, 1992; http://www.nytimes.com/1992/01/25/us/lawsuit-settled-over-heart-valve-implicated-in-about-300-deaths.html

- Barry Meier, "Maker of Heart Valve Balks Over Some Warnings," New York Times, April 26, 1992; http://www.nytimes.com/1992/04/26/us/maker-of-heart-valve-balks-over-some-warnings.html

- Barry Meier, "Pfizer Unit to Settle Charges of Lying About Heart Valve," New York Times, July 2, 1994; http://www.nytimes.com/1994/07/02/business/pfizer-unit-to-settle-charges-of-lying-about-heart-valve.html

- "The Media Business: Pfizer's Pact on Plax Ads," New York Times, February 21, 1991; http://www.nytimes.com/1991/02/21/business/the-media-business-advertising-pfizer-s-pact-on-plax-ads.html

- "California: 19 States Settle with Pfizer over Drug Ads," Los Angeles Times, January 7, 2003 (via Nexis).

- "Pfizer Cancels Lipitor Ads," Washington Post, February 26, 2008 (via Nexis).

- Gardiner Harris, "Pfizer to Pay $430 Million Over Promoting Drug to Doctors," New York Times, May 14, 2004; http://www.nytimes.com/2004/05/14/business/pfizer-to-pay-430-million-over-promoting-drug-to-doctors.html

- Stephanie Saul, "Experts Conclude Pfizer Manipulated Studies," New York Times, October 8, 2008; http://www.nytimes.com/2008/10/08/health/research/08drug.html

- "Pfizer to Pay $49 Million in Fraud Cases," New York Times, October 29, 2002; http://www.nytimes.com/2002/10/29/business/pfizer-to-pay-49-million-in-fraud-case.html

- Stephanie Saul, "TV Ad for Pfizer's Painkiller Criticized by Consumer Group," New York Times, April 10, 2007; http://www.nytimes.com/2007/04/10/business/media/10celebrex.html

- Stephanie Saul, "Pfizer in $894 Million Drug Settlement," New York Times, October 18, 2008; http://www.nytimes.com/2008/10/18/business/18drug.html

- Gardiner Harris, "Pfizer to Pay $2.3 Billion to Settle Inquiry Over Marketing," New York Times, September 3, 2009; http://query.nytimes.com/gst/fullpage.html?res=9500E3D8143CF930A3575AC0A96F9C8B63&scp=2&sq=Pfizer+%2B+%242.3+Billion&st=nyt

- Joe Stephens, "Where Profits and Lives Hang in the Balance," Washington Post, December 17, 2000 (via Nexis).

- Joe Stephens, "Panel Faults Pfizer in '96 Clinical Trial in Nigeria," Washington Post, May 7, 2006; http://www.washingtonpost.com/wp-dyn/content/article/2006/05/06/AR2006050601338.html

- Joe Stephens, "Pfizer to Pay $75 Million to Settle Trovan-Testing Suit," Washington Post, July 31, 2009; http://www.washingtonpost.com/wp-dyn/content/article/2009/07/30/AR2009073001847.html

- http://library.corporate-ir.net/library/78/781/78193/items/283760/Wyeth_FR_07_lo.pdf

Product Liability Litigation

The annual report of Wyeth contains a 15-page section describing the long list of lawsuits and regulatory proceedings the company is facing. Most of the lawsuits are product liability cases involving products such as hormone therapy, childhood vaccines, the anti-depressant Effexor, and the contraceptive Norplant.

The most significant of these is the litigation involving the combination diet drug known as fen-phen, which was withdrawn from the market more than a decade ago after reports that its use was linked to possibly fatal heart valve damage. The findings unleashed a wave of tens of thousands of lawsuits against the company, including a case in Texas in which a jury awarded a single plaintiff more than $1 billion in damages. The company set up a $3.75 billion fund as part of the attempted resolution of a national class action case. Another $1.3 billion was added to the fund in 2006. Many plaintiffs opted out of the class and negotiated individual settlements with the company. Wyeth has paid well over $10 billion to resolve lawsuits over the drug.

In November 2008, a state appeals court reinstated a San Francisco woman's lawsuit accusing Wyeth of failing to warn of the risk of a muscular disorder she contracted after using the company's anti-heartburn medication. According to the San Francisco Chronicle, the plaintiff, Elizabeth Conte, "said she came down with tardive dyskinesia, an incurable condition that causes repeated involuntary muscle movements, after taking the generic version of Reglan…She sued the generic manufacturers as well as Wyeth, Inc., maker of the widely prescribed Reglan claiming their labels understated the dangers of long-term use."

Thousands of women have sued Wyeth after taking Premarin or another HRT drug and developing breast cancer. In 2008, a jury awarded three such Nevada women $134 million (later reduced to $58 million).

Advocates for animals have long decried Wyeth's hormone replacement therapy (HRT) drug, Premarin, obtained from the urine of pregnant horses confined in cramped stalls, denied free access to water and made to stand up for twenty hours a day, only to be auctioned and slaughtered when too old to bear foals.

Now Wyeth and other firms are "hoping the Supreme Court will sharply curb" the "right to sue drug companies for deaths or injuries caused by medicines" (Wall Street Journal, 10/27/08). In Wyeth vs. Levine, a Vermont guitarist who lost an arm to gangrene caused by an improperly administered nausea drug was awarded $6.7 million in damages by a jury accepting her argument that Wyeth should have put stronger warnings on the label. Vermont's highest court upheld the verdict, but in an appeal Wyeth seeks what a New York Times editorial (11/7/08) described as "grant(ing) drug companies immunity based on a phony assertion that state lawsuits improperly usurp federal regulatory authority."

FDA Rejects Several Wyeth Drugs

According to Alternet.org of the Independent Media Institute, the Food and Drug Administration (FDA) in 2007 " …rejected Wyeth's osteoporosis drug, bazedoxifene, because of stroke and blood clot problems, its schizophrenia drug, bifeprunox, because it was not as effective as other drugs on the market and its menopause drug, Pristiq, because of serious heart or liver complications experienced by trial participants."

Wyeth Involved in Medical Ghostwriting Scandal

The New York Times reported on December 12, 2008 that “Wyeth, the pharmaceutical company, paid ghostwriters to produce medical journal articles favorable to its female hormone replacement therapy Prempro, according to Congressional letters seeking more information about the company's involvement in medical ghostwriting. At least one article was published even after a federal study found the drug raised the risk of breast cancer…”

According to the Times, Sen. Charles Grassley (R-Iowa) in December 2008, wrote to Wyeth's Chairman and CEO Bernard Poussot: "Any attempt to manipulate the scientific literature, that can in turn mislead doctors to prescribe drugs that may not work and/or cause harm to their patients, is very troubling." [see link to full article below]

Racial Discrimination Charges

Seven racial discrimination lawsuits have been filed against Wyeth by current and former employees at its plant in Pearl River, New York. The cases are still pending.

Pfizer/Wyeth Deal a Distaster

Paul Rogat Loeb, author of The Impossible Will Take a Little While: A Citizen's Guide to Hope in a Time of Fear, named the #3 political book of 2004 by the History Channel and the American Book Association wrote in a January 28, 2009 article in Commondreams.org about Pfizer's recent acquisition of Wyeth:

"Are U.S. taxpayers getting stiffed? Pfizer, Viagra's daddy, is using money from taxpayer-bailed-out banks to help buy major pharmaceutical competitor Wyeth in a $68 billion deal. That won't help taxpayers or consumers. Nor is it designed to. It will harm the companies' workers, 20,000 of whom will likely be laid off. It's even likely to hurt small bio-tech companies, drying up potential sources of capital and leaving fewer potential major investors or purchasers.

"The deal may be good for Pfizer, helping the company recover from a $2.3 billion legal settlement over misleading marketing on the pain reliever Bextra, and helping them amplify the clout of the $3 million they recently spent lobbying against the right to import cheaper drugs from Canada. But it won't help the rest of us."

Below are excerpts from news articles highlighting troubling issues with the company. See for yourself, and draw your own conclusions.

U.S., States Join Lawsuits On Wyeth Drug Sales

By Avery Johnson

The Wall Street Journal / May 19, 2009

http://online.wsj.com/article/SB124268886164832139.html

The Justice Department and 16 states joined two whistleblower lawsuits alleging that Wyeth defrauded the government by offering discounts to hospitals on two of its drugs that it didn't offer to Medicaid.

The lawsuits, filed in federal District Court in Massachusetts, claim that Wyeth avoided paying hundreds of millions of dollars in rebates to state Medicaid programs for its Protonix Oral and Protonix IV acid-reflux drugs. Wyeth sold $394 million of the drugs in 2008, but they brought in close to $2 billion a year in revenue before generic competition threatened them…

Drug firm Wyeth accused of defrauding Medicaid

By Devlin Barrett

Associated Press / May 19, 2009

http://www.boston.com/business/healthcare/articles/2009/

05/19/drug_firm_wyeth_accused_of_defrauding_medicaid/

"The Justice Department accused Wyeth, one of the nation's biggest drug makers, yesterday of cheating Medicaid programs out of hundreds of millions of dollars by overcharging for a stomach acid drug…"

Despite 5,000 Lawsuits, Wyeth Hopes For

Hormone Replacement Therapy Comeback

By Martha Rosenberg,

AlterNet / February 26, 2008.

http://www.alternet.org/story/77906/

A reduction in a jury award from $134 million to $58 million for a drug that caused cancer would not normally be cause to rejoice. But it has not been a normal year for hormone maker Wyeth.

The Madison, NJ-based drug company faces 5,300 Prempro- and Premarin-related law suits in addition to the one it just lost — but with damages reduced — in Reno, NV brought by three women with breast cancer…

Selling a product that causes cancer isn't easy for Wyeth…

Nor is the Food and Drug Administration (FDA) rubber stamping new drugs from the company which made fenfluramine/phentermine and some say has a "safety second" culture.

Last year it rejected Wyeth's osteoporosis drug, bazedoxifene, because of stroke and blood clot problems, its schizophrenia drug, bifeprunox, because it was not as effective as other drugs on the market and its menopause drug, Pristiq, because of serious heart or liver complications experienced by trial participants…

Since HRT was found by the Women's Health Initiative in 2002 to cause a 26 percent increased risk of breast cancer, 29 percent increased risk of heart attack, 41 percent increased risk of stroke and 100 percent increased risk of blood clots, a study in the January issue of Cancer Epidemiology, Biomarkers and Prevention found the cancers also move quickly.

Premarin

"It's a Scandal! It's an Outrage!"

NEW HORMONE REPLACEMENT THERAPY WITH A NEW NAME TO BE APPROVED BY THE FDA AFTER ONLY TWO YEARS OF TESTING!!! APRELA USES PREGNANT MARES URINE!!!

Tuesday's Horse

A Weekly Publication of The Fund for Horses

Written by RACHEL STONE

Oct 28, 2008

http://www.equinevoices.org/premarin.php

A large portion of Bob's [Essner] earnings come from Wyeth's hormone replacement therapy (HRT) drugs – what Wyeth calls their Premarin® Family of drugs which include Premarin®, Premphase® and Prempro®. Most of you probably already know that Premarin® is short for pregnant mare's urine. But just in case, yes siree, these drugs are made with conjugated equine estrogens (CEE) collected from the urine of pregnant horses. The circumstances the mares, foals and stallions face during their interface with the PMU farmers, and afterwards (their lives often end in slaughter for human consumption overseas) are questionable at best…

… in 2002, when a study undertaken by the Women's Health Initiative disclosed that the use of Wyeth's HRT drugs increased the risks of strokes, blood clots, heart attacks, heart disease and breast cancer in women, pee hit the fan. Sales plummeted 32% in 2003 and another 31% in 2004…

…since 2005, sales have steadily gained. In 2007 alone, the Premarin® Family of drugs earned Wyeth $1,055,300,000. That's a lot of money! Though still less then the $1.9 billion Wyeth earned in 2002. And with sales just over half of what they used to be, Bob's gotta' do something, right?

Y'ever heard of Aprela? Aprela, is a new drug under development at Wyeth that targets both menopause symptoms and osteoporosis. The drug is now in phase 3 clinical trials and expected to be submitted for FDA approval during the first half of 2009. Aprela's success could be a real boon for Bob. According to International Marketing Services (IMS), the osteoporosis market is much larger than the menopause market - generating international sales of $8.9 billion in 2007. And guess what. Aprela contains the same CEE found in Wyeth's Premarin® Family of drugs. Talk about smart marketing! Not only did Bob rename the drug, he's mixed it with a new batch of ingredients, targeted a larger market and targeted a market that's expected to increase as baby-boomers age!

…Will Wyeth once again “hire” tens of thousands of mares in order to collect their excrement? How many more unwanted horse babies will be born each year? How many more horse moms will have to stand in a 3 1/2' X 8' stall for a solid six months out of every year? Since I couldn't get anyone from Wyeth on the phone or via email, the questions linger.

Wyeth's HRT drugs are or aren't the be all and end all. But I do know there are plenty of tested, effective plant and synthetic alternatives on the market these days. And I do know women transitioned through menopause drug-free for millennia (and still do).

Ramona woman saves horses from slaughter

By Pat Sherman, Staff Writer

San Diego Union Tribune / April 25, 2004

http://www.signonsandiego.com/uniontrib/20040425/news_2m25pmu.html

The rescued horses come from Canadian farms, where the urine of pregnant mares is collected and sold to Wyeth Pharmaceutical, which uses it to make Premarin, a drug used in hormone replacement therapy. After the mares give birth in the spring, their foals are largely disposable…

Rescue efforts began in the mid-1990s. Animal-rights activists were enraged at conditions they said the horses faced. The mares, they said, were confined to narrow stalls for up to 20 hours a day, five months at a time, while strapped to uncomfortable collection pouches. They often had no room to lie down and got little or no exercise, the activists said…

The decline in Premarin production can be attributed to a series of studies commissioned by the Women's Health Initiative, a federal research program to address medical issues faced by postmenopausal women. A study in July 2002 found that women on a combination of Premarin and progestin had a higher incidence of strokes, heart attacks, blood clots and breast cancer than those taking a placebo.

EDITORIAL

The Court Confronts a Grievous Injury

The New York Times / November 7, 2008

http://www.nytimes.com/2008/11/07/opinion/07fri1.html

On Monday, the court heard arguments in the case of a Vermont musician who lost her arm after being injected with an anti-nausea drug. There is no doubt that Diana Levine was badly injured by a drug made by Wyeth…

Ms. Levine quickly developed gangrene; her hand and lower arm had to be amputated. She sued the physician's assistant, the supervising physician and the clinic for malpractice and won an out-of-court settlement, as well she should have.

Then she sued Wyeth for failing to warn the clinicians to use the much safer “IV drip” technique, in which the drug is injected into a stream of liquid flowing from a hanging bag that already has been safely connected to a vein, making it highly unlikely that the drug will reach an artery. A trial court awarded her $6.7 million, and the Vermont Supreme Court upheld the verdict. Now Wyeth, supported by the Bush administration, has asked the Supreme Court to reverse the verdict on the grounds that Wyeth complied with federal regulatory requirements.

We do not buy Wyeth's argument that it did everything it needed to, or could have done, to warn doctors about the dangers involved in the treatment Ms. Levine received.

S.F. court revives suit vs. Wyeth over generic

Bob Egelko, Chronicle Staff Writer

San Francisco Chronicle / Saturday, November 8, 2008

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2008/11/07/BAG0140D65.DTL

A state appeals court reinstated a San Francisco woman's lawsuit Friday against a drug manufacturer she accused of failing to warn of the risk of a muscular disorder she contracted after using the company's anti-heartburn medication.

Elizabeth Conte said she came down with tardive dyskinesia, an incurable condition that causes repeated involuntary muscle movements, after taking the generic version of Reglan for nearly four years. She sued the generic manufacturers as well as Wyeth Inc., maker of the widely prescribed Reglan, claiming their labels understated the dangers of long-term use…

…the court in Conte's case said it saw nothing unfair about requiring Wyeth to "shoulder its share of responsibility" for an illness caused, at least in part, by its alleged failure to provide accurate warnings.

Drug Maker Said to Pay Writers for Journal Articles

By DUFF WILSON

The New York Times / Demeber 12, 2008

http://www.nytimes.com/2008/12/12/business/13wyeth.html

Wyeth, the pharmaceutical company, paid ghostwriters to produce medical journal articles favorable to its female hormone replacement therapy Prempro...At least one article was published even after a federal study found the drug raised the risk of breast cancer…

“Any attempt to manipulate the scientific literature, that can in turn mislead doctors to prescribe drugs that may not work and/or cause harm to their patients, is very troubling,” Mr. Grassley, an Iowa Republican, wrote Friday to Wyeth's chairman and chief executive, Bernard J. Poussot.

Wyeth employee wants race discrimination lawsuit to stand

BY ALLAN DRURY

THE JOURNAL NEWS • DECEMBER 30, 2008

http://www.lohud.com/article/20081230/BUSINESS01/812300330

Gibson, 46, is one of eight black current and former Wyeth employees who have sued the company for race discrimination.

Not What the Doctor Ordered

By Steven Pearlstein, Washington Post

Wednesday, January 28, 2009;

http://www.washingtonpost.com/wp-dyn/content/story/2009/

01/27/ST2009012703641.html?tid=informbox

Three things are indisputably true about the pharmaceutical industry:

Over the past decade, there has been significant cross-border consolidation, involving major pharmaceutical companies and promising biotech firms.

Whatever operating efficiencies that consolidation may have generated, none of it was passed on to consumers in the form of lower prices.

During the same period, there has been a steady decline in the number of important new drugs flowing from company research labs.

All of which ought to raise serious questions about why the government's antitrust regulators should approve the latest industry mega-merger in which No. 2 Pfizer proposes to buy No. 11 Wyeth in a deal valued at $68 billion.

Stiffed: Why Are Bailed-Out Banks Helping Pfizer Buy Wyeth?

by Paul Rogat Loeb

Common Dreams / January 28, 2009

http://www.commondreams.org/view/2009/01/28-3

Are U.S. taxpayers getting stiffed? Pfizer, Viagra's daddy, is using money from taxpayer-bailed-out banks to help buy major pharmaceutical competitor Wyeth in a $68 billion deal. That won't help taxpayers or consumers. Nor is it designed to. It will harm the companies' workers, 20,000 of whom will likely be laid off. It's even likely to hurt small bio-tech companies, drying up potential sources of capital and leaving fewer potential major investors or purchasers.

The deal may be good for Pfizer, helping the company recover from a $2.3 billion legal settlement over misleading marketing on the pain reliever Bextra, and helping them amplify the clout of the $3 million they recently spent lobbying against the right to import cheaper drugs from Canada. But it won't help the rest of us.